Generate and analyze Forms W-2 & W-3 in QuickBooks Pro Desktop 2019 Generate and analyze Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return in QuickBooks Pro Desktop 2019 Generate and analyze Form 941 Employer's Quarterly Federal Tax Return in QuickBooks Pro Desktop 2019 Generate payroll journal entries from payroll reports in QuickBooks Pro Desktop 2019

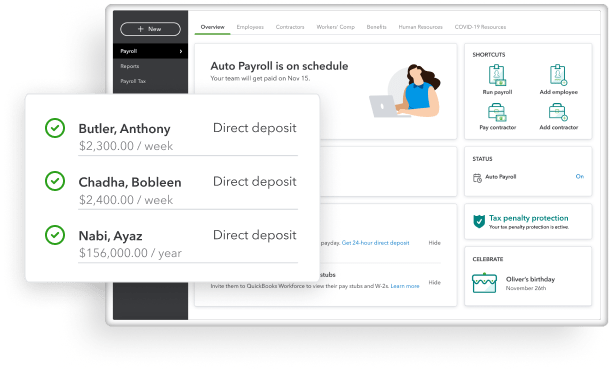

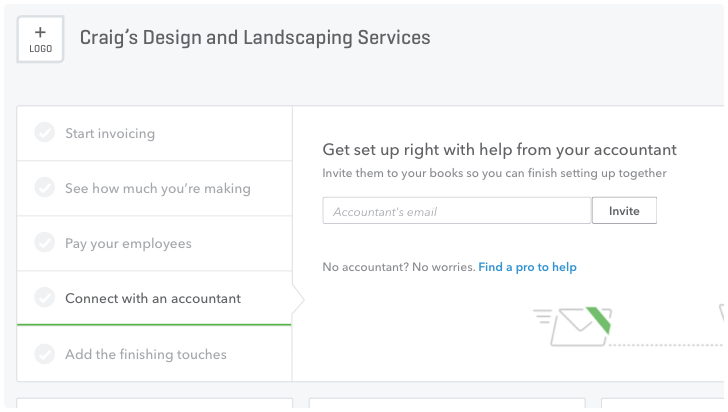

Set up and calculate Federal Unemployment in QuickBooks Pro Desktop 2019ĭescribe and calculate employer payroll taxes in QuickBooks Pro Desktop 2019 Set up and calculate Medicare in QuickBooks Pro Desktop 2019 Set up and calculate social security in QuickBooks Pro Desktop 2019 Set up and calculate Federal Income Tax (FIT) In QuickBooks Desktop Pro 2019ĭescribe the Federal Income Contribution Act and its components List and describe payroll related legislationĮnter new employee information into QuickBooks and describe where to get the data necessary to add a new employee Processing QuickBooks Pro Desktop 2019 payroll for a small business, generating paychecks, processing payroll tax forms

0 kommentar(er)

0 kommentar(er)